Financial Advisory Platform Development

What Client Says ?

Mark Wilson

” Dextersol helped us turn our vision into a reality with a platform that exceeds both in functionality and ease of use. The aspect of technical competence, together with the possession of user requirements, has been embraced to the maximum by them. We have seen great improvements and the response from our clients much to our delight. “

Services Provided

Web and Mobile Development

Web and Mobile Design

Project Overview

Dextersol partnered with a top financial advisory company to create and launch an open and innovative financial planning and investment solution. A range of features include detailed professional financial recommendations, advanced tools for portfolio management, and, finally, simple access to financial advisors. The solution will be available to individuals and business entities. It will enable them to stick to proper financial management approaches that help them achieve the greatest growth and sustainability.

Key Features of the Financial Advisory Platform

Canada-based Tulip Financial

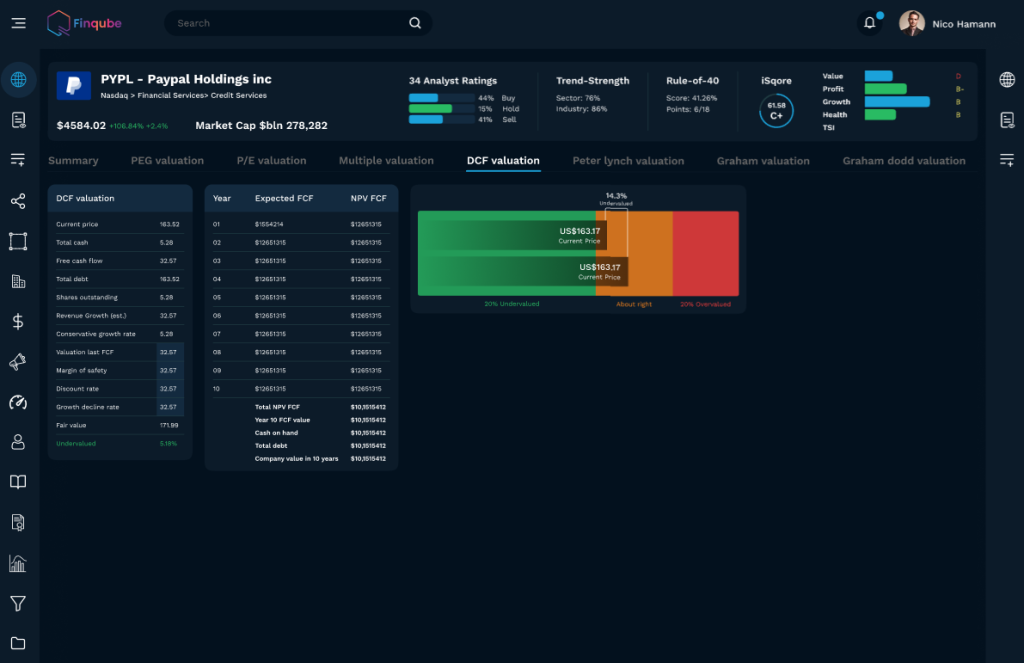

‘Personalized Financial Insights,’ which is a tool that is supposed to give users statistical and analytical information pertaining to their spending habits and the amount of money they have in their accounts.

The platform uses AI-driven analytics to deliver tailored financial insights based on:

The income generated, questions regarding expenditure and occurrences of saving/disposable earnings.

Portfolio Management Tools

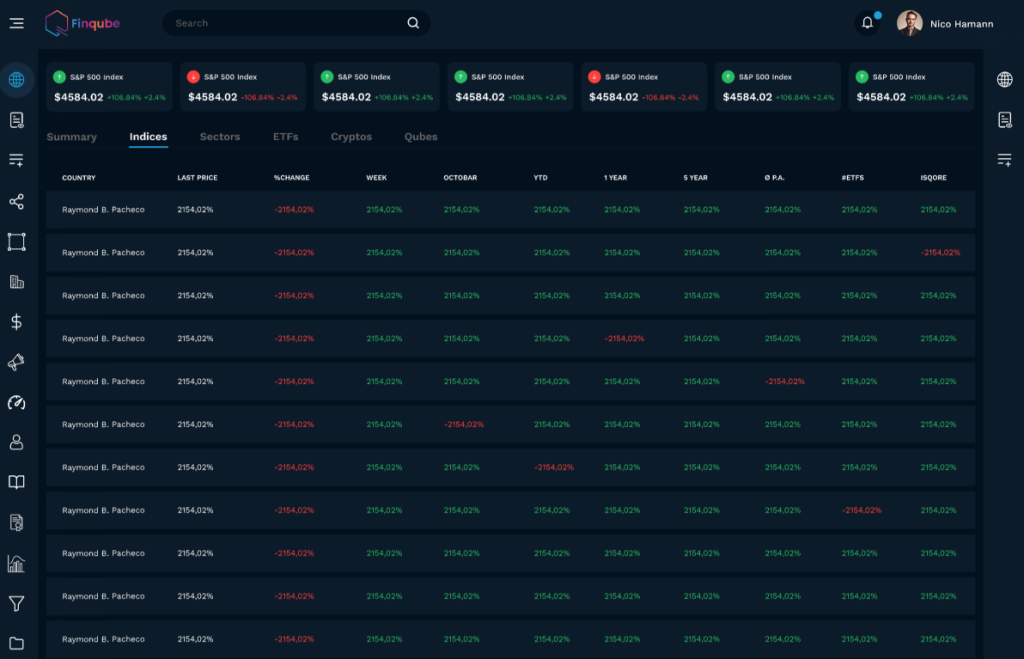

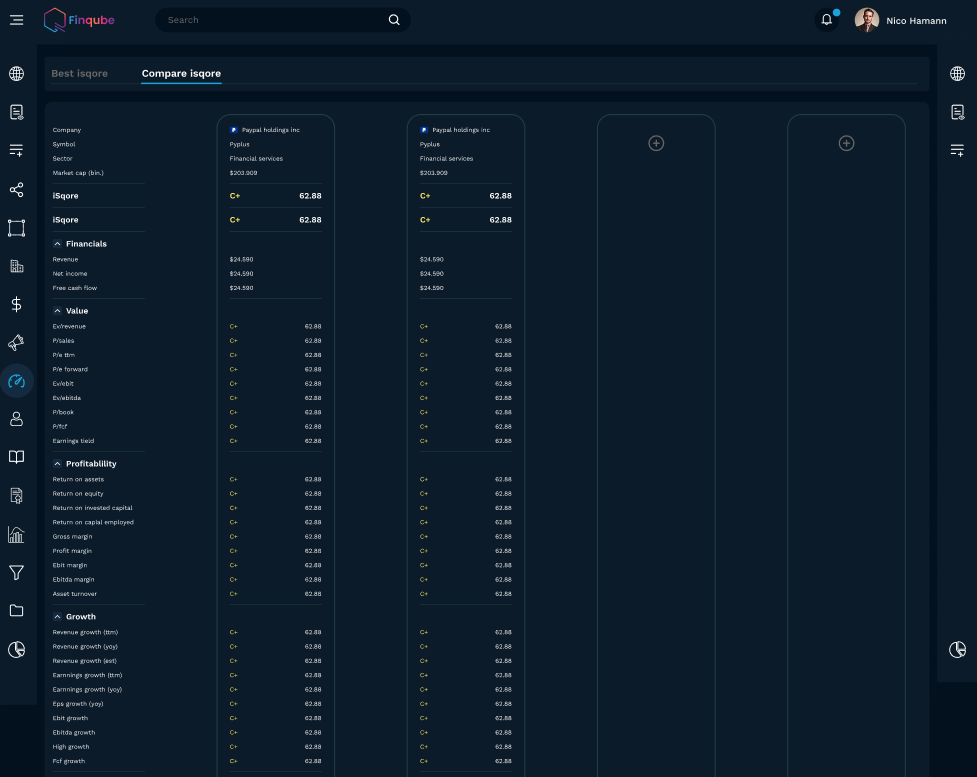

Users can monitor and manage their investment portfolios through features like:

Real time portfolio tracking.

✦ Performance analysis and creating graphical and informative dashboards.

✦ Recommendations that aim at diversifying returns in order to maximize the returns.

Goal-Based Financial Planning

The platform lets the users define certain financial targets, including education, purchasing property or home, and retirement. It then proceeds to create goal realization strategies at each stage in achieving these goals while staying financially solvent.

Access to Expert Advisors

To enhance user confidence, the platform integrates a virtual consultation feature, enabling users to:

✦ Make appointments with a licensed financial planner.

✦ Consult trusted professionals on a range of situations, including budgeting, taxes and investment.

The Execution

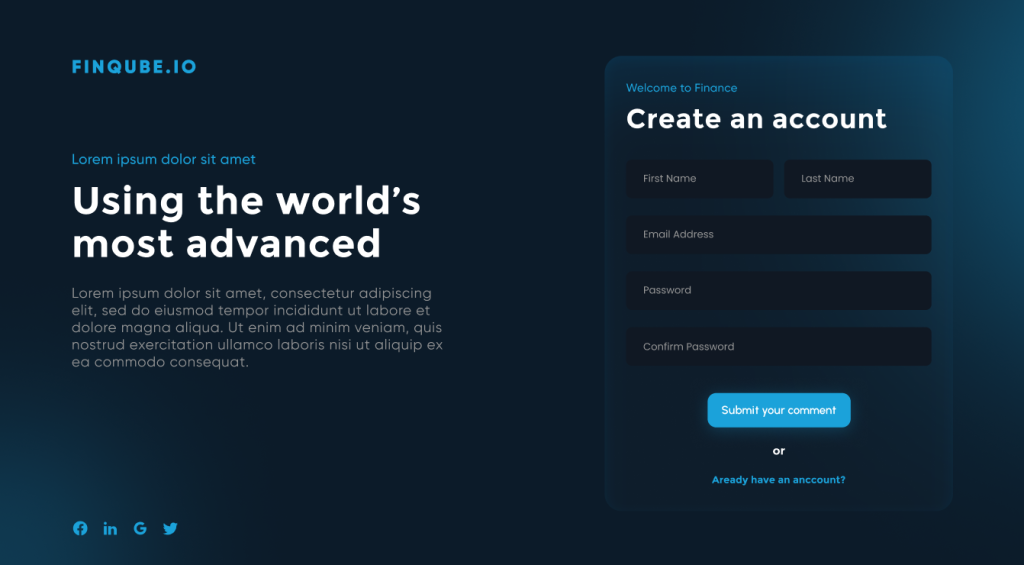

Dextersol proceeded with the implementation of the project, having a well laid down plan, thus implementing it successfully. This was followed by a number of consultations with the client in order to determine the goals of the platform as well as users’ requirements. Our UX/UI designers were designing easy-to-understand wire framing when it came to designing different aspects of the platform.

Finally, our developers used agile processes to turn this platform into a reality after the design phase. Every single module that forms the core of the engine, including the portfolio management tools and the secure transaction processor, went through elaborate and elaborate and tough cycles of design and testing to ensure that the solutions developed are dependable, swift and secure. The combined setting facilitated the incorporation of feedback into the process of the subsequent sprint implementation.

While in deployment, Dextersol made it their responsibility to train the client’s team on how to manage and operate the platform. Such support as performance diagnostics and constant monitoring of the platform with the provision of frequent updates ensuring its maximum efficiency and protection were also included in post-launch support.

Challenges & Solutions

Challenges

Some challenges are that the platform had to be built to scale, accommodating a growing user base and an expanding set of financial products and services and you will need to reconcile large models of accounting numbers while presenting neat and tidy models for end consumption.

Ensuring the platform adhered to strict financial regulations, including data privacy laws (such as GDPR and CCPA), was critical. Additionally, integrating real-time financial data from various markets and investment instruments was necessary to help clients track their portfolios and make informed decisions.

Solutions

Dextersol’s approach to developing the financial advisory platform was centered on user-centric design, secure architecture, and cutting-edge technology through; collaborating closely with the client’s financial advisors and IT teams to understand their vision, user needs, and regulatory requirements. To interface with the banks, brokers and payment systems, our developers put in place strong APIs.

Dextersol’s team followed modular principles, which means that even complicated functions were divided into segments that can be easy to navigate. Collaborated with legal and compliance teams to ensure the platform adhered to relevant financial regulations, including GDPR, CCPA, and SEC guidelines.

Results

90%

Users found the platform

50%

Consultation booking feature

40%

Improvement

The result is that the over 90% of users found the platform intuitive and easy to navigate during the beta testing phase. The consultation booking feature saw a 50% increases in advisor-client interactions within the first three months. Users reported a 40% improvement in their understanding of financial concepts, as measured by platform feedback surveys.